It’s been an eventful 12 months at Erickson Inc. — the famed manufacturer of the S-64 Aircrane, operator of the largest S-64 fleet in the world, and vastly experienced maintenance, repair, and overhaul provider. In April 2017, the Portland, Oregon-based company drew a line under the most traumatic period in its almost 50-year history, as it formally exited a Chapter 11 bankruptcy process. Within a week, it then lost its president and CEO. Yet today, restructured and with a new CEO at the helm, the future looks a lot brighter for the company — and its enormous variety of customers around the world.

When Vertical last visited Erickson Inc. in October 2014, it was a very different company. At the time, it appeared to be riding high on a wave of growth, following its acquisitions of Evergreen Helicopters and Air Amazonia in 2013. These moves essentially transformed Erickson overnight, taking it from about 700 employees and a fleet of 20 Aircranes, to 1,150 staff and a mixed fleet of 86 rotary- and fixed-wing aircraft, and moving it into new markets, such as disaster relief and military logistics, as well as onshore and offshore oil-and-gas.

However, the acquisitions also saddled the company with a huge debt burden — and this became a major problem as the industry entered a period of unprecedented operational headwinds. The Evergreen purchase also drew close scrutiny from regulatory agencies — and the company’s shareholders. It ultimately became the subject of a shareholders’ class-action lawsuit, alleging a breach of fiduciary duty, which was settled in June 2016 with an $18.5 million payment from Erickson and the private equity company that controlled it.

The reverberations of the expansion continued, and on Nov. 8, 2016, citing “numerous business challenges” impacting its operating results and asset values, Erickson Inc. filed for relief under Chapter 11 of the U.S. Bankruptcy Code. At the helm during this transitional period for the company was Jeff Roberts, who took over as president and CEO after Udo Rieder retired in March 2015.

While the company’s leadership scrambled to restructure the company and confirm its plan of reorganization with the bankruptcy court, business on Erickson’s various front lines continued as normally as possible.

Within six months of beginning the process, and under new ownership comprised of a diverse shareholder group, Erickson exited bankruptcy. Roberts then resigned as president and CEO, leaving Andrew Mills, the company’s president of commercial aviation, as its interim president and CEO. On Aug. 31, 2017, the appointment of government services veteran Doug Kitani as CEO allowed it to firmly establish a course for a more positive future.

Kitani, who started his career as a U.S. Army helicopter pilot flying the Bell UH-1, OH-58, and Sikorsky UH-60, arrived at Erickson from IAP Worldwide Services — where he led the company from a similar position.

“It was a distressed company and out of court restructuring, and we turned it around successfully and had a great several-year run,” he said.

So committed was Kitani to continuing the path of growth with IAP, he turned Erickson down when first approached for the position in early 2017. However, one of his mentors convinced him to have a conversation with the company and the new owners to learn more about the opportunity. It turned out to be the perfect fit.

“I’m an aviator, so that was a big part of me getting involved in this,” he said. “And I think we have an opportunity at Erickson to build a diversified aerospace and defense company. It has some great crown jewels inside the portfolio and great people, great assets. I’m looking forward to doing what we can organically to get us growing.”

Three key segments

Today, Erickson has about 750 employees, and three clear business segments: commercial aviation services (firefighting, powerline and construction); defense and national security (providing aviation support to government services/military); and manufacturing and maintenance, repair, and overhaul (MRO).

“What excites me about the company is this notion that we are incredibly vertically integrated; perhaps the most vertically integrated aerospace company that I’ve seen, in terms of our legacy of manufacturing and maintaining the S-64, and how that plays out in terms of how we operate the airframe globally in a variety of mission sets and austere environments that are very demanding,” said Kitani. “That’s also [the case] with our defense and national security business which, likewise, we’re typically operating legacy airframes — whether it’s [AS332] Pumas or Beechcraft [1900s], or even the Bell 214s — and doing it in pretty challenging environments for our customers.”

While Erickson’s commercial work (and firefighting in particular) is a key part of its business, Kitani has high hopes for development in its other two business segments.

“What we’ve been endeavoring to do is move into military markets, and I believe this company has a significant right to play in those markets — particularly on the rotary-wing side, but potentially other airframes and platforms, as well,” said Kitani. “As the global threat environment changes, we’re seeing interest from customers within DoD [U.S. Department of Defense] that require air-ops support. It could be anywhere around the world, and we happen to have the kinds of airframes and capabilities that they like, so we’re pursuing that.”

But it’s the company’s MRO capabilities that he believes offer the largest potential for growth. With its experience in providing OEM-level support to legacy airframes such as the S-64 Aircrane and the Bell 214, he said it has developed the experience and expertise to come up with creative solutions to unique engineering problems.

One such example is the company’s work on the H-53E Maintenance Program. Initially established to support the reconstitution of two MH-53Es for the U.S. Navy, the workload on this project subsequently expanded to an MRO services product line.

“We view the MRO segment as being one that, in terms of value added, engineering and specialty MRO — and almost non-standard MRO — that’s the area we think we can really grow,” said Kitani.

Varied operations

There are 20 S-64s (E and F models) in the Erickson fleet, along with Bell 214s and Airbus AS330/AS332s. On the fixed-wing side, it has Beechcraft 1900Ds and CASA 212s.

The iconic Aircrane is at the core of Erickson’s identity, and its continued success. With the E model’s ability to lift 20,000 pounds (9,000 kilograms) and the F model able to carry 25,000 pounds (11,340 kilograms), the aircraft offers unique capabilities in both firefighting and aerial construction.

Almost a third of the Aircrane fleet is occupied year-round on long-term firefighting contracts, cycling between the Northern and Southern Hemisphere fire seasons in Greece and Turkey, and Australia. Other major ongoing contracts include logging operations in Canada, and power transmission line construction in Scotland, India, and Canada.

Indeed, Kitani highlighted transmission line work as an area of great opportunity for the company.

“That’s an interesting growth market; it’s still relatively small in terms of its contribution to our revenue, but it’s very fast-growing and we expect the growth to accelerate for us,” he said.

The Bell 214s are currently exclusively used on DoD contracts, and, together with the AS330s/AS332s, provide transport and logistical support for the military and government agencies. Three such contracts see the Pumas flying vertical replenishment (VERTREP) operations for the U.S. Navy in the Pacific and Middle East.

“Our ships give them fuel supplies, food, and water,” said Chris Callahan, Erickson’s VERTREP program manager and Airbus fleet manager. “We resupply any of the coalition forces, so we could be resupplying the U.S. to the Japanese, to the Koreans, to Australia, New Zealand — whenever there’s joint operations or exercises, we’re always in the mix.”

The vast majority of the pilots and engineers assigned to these contracts are ex-military. “We do have a few that have never been in the military — they come from the [part] 133 world, where they’re used to logging and doing construction work,” said Callahan.

He said the Puma is well suited to VERTREP operations, with the ability to carry up to 7,700 pounds (3,500 kilograms) on the hook.

“It’s a great performer — it’s a really good lifting machine, it’s a very nimble machine,” said Callahan. “We have seating for eight plus one in the jump seat, which works out just fine. It gives us plenty of room for additional cargo in the aircraft, so that we can carry passengers plus other baggage internally.”

Erick Nodland, Erickson’s director of operations, said there was a clear opportunity for the company to develop its defense and national security work.

“It’s a new fiscal year for the military, we have a CEO that has a huge background in defense and the defense service industry, and we have a new [U.S.] president,” he said. “The military is shifting their focus and we’re just finding that we’re part of that. We’re part of that directly in some ways, and we’re part of that indirectly in bidding.”

Manufacturing growth

Erickson purchased the type certificate for the S-64 from Sikorsky in 1992, and has produced 35 of the type since then. During Vertical’s recent visit to the company’s manufacturing and MRO facilities in Central Point, Oregon, it was busily working on the sixth S-64E to be built for the Korea Forest Service (KFS), which is set to be delivered later this year. In February, the KFS announced an order for two more S-64Es, which will eventually bring its Aircrane fleet to eight aircraft. The new aircraft will be delivered with firefighting tanks, sea snorkels, foam cannons, glass cockpits, composite main rotor blades, and will be fully night vision compatible.

Kitani said the success of the KFS program is a great example to show to other agencies and operators.

“The Korean order really helps to legitimize this notion of buying and owning, and buying and operating the Aircrane,” he said. “Since the Napa [Valley] fires and the horrific fire season in California, there’s been a lot more interest from customers about potentially building and buying new Aircranes from us for aerial firefighting.”

The S-64s Erickson produces are converted from CH-54 Tarhe airframes, which are stripped down and built up in three parts: the cockpit, central fuselage, and tail boom. The latter is built from scratch.

The lead time for a new Aircrane is 18 to 24 months, but Kitani said Erickson is looking to speed this up, and offer other options for those looking to operate an aircraft in the near future.

“We’ve got a couple of customers who we’re in active dialogue with where . . . they’re very focused on how they can get the capacity sooner rather than later,” he said. “So we’ve talked to them about other permutations like potentially selling one of our Aircranes that’s in our existing fleet and then building a new one — and we could either keep the new one as part of our fleet, or even potentially swap it out with the one they’d been operating.”

In addition to building new airframes, Erickson also supports the global fleet of S-64s, making the likes of Siller Brothers and Helicopter Transport Services (HTS) both customers and competitors. From the latter, Erickson recently received an order for two of its in-house 2,650-gallon (10,000-liter) firefighting tanks, which were being painted in HTS colors at the time of Vertical’s visit in November.

Erickson also serves as a third party manufacturer for the OEMs, producing parts for aircraft including the Bell V-22 and 525 Relentless.

One of the most exciting developments for Erickson’s manufacturing unit is the upcoming certification of composite main rotor blades for the S-64, slated for the second quarter of 2018. After initially looking to outsource the program, Erickson, in collaboration with Aircrane operator HTS, has spent seven years taking the blades from the drawing board to the edge of certification.

The existing metal rotor blades for the E and F model Aircrane are specific to those types, but the new composite blades will be essentially identical — the difference between them is in the the cuff that attaches to the rotorhead and the counterweights at the tip. Still, the blades need to be certified separately on each type. Erickson completed high altitude performance testing over the winter for the F model’s blades in Cusco, Peru, while the E model’s high altitude testing will likely be done in Leadville, Colorado, this summer. Once both are certified, the blades can go to market.

Until the performance testing is complete, the full benefits of the new blades will not be disclosed, but anecdotal reports from pilots indicate a greatly improved torque value and fuel efficiency, and a huge reduction in vibration within the aircraft — which would likely have knock-on benefit to other components, as well as reducing pilot fatigue. According to Amanda Hammerschmith, composite main rotor blade program manager, the composite blades have shown incredible durability during testing.

While physically very similar in size and weight to the metal blades, the composite blades are easy to spot, with a striking swept tip and bright white finish. The tips of the blades are painted matte black after early testing found the shiny white paint resulted in a glare in the cockpit.

An MRO focus

While there are certainly promising signs in its manufacturing department, it’s on the MRO side of the house that the company has seen the most dramatic growth. In February 2015, it signed an agreement with Bell that saw Erickson assume product support responsibility for the Bell 214 B and ST models, including spare parts supply, technical assistance, maintenance training, and MRO services.

“With that, we inherited [support for] around 10 to 12 operators,” said Justin Saxbury, global customer service manager at Erickson. “We were uniquely positioned to not only offer our manufacturing capabilities, but also our engineering and overhaul expertise.”

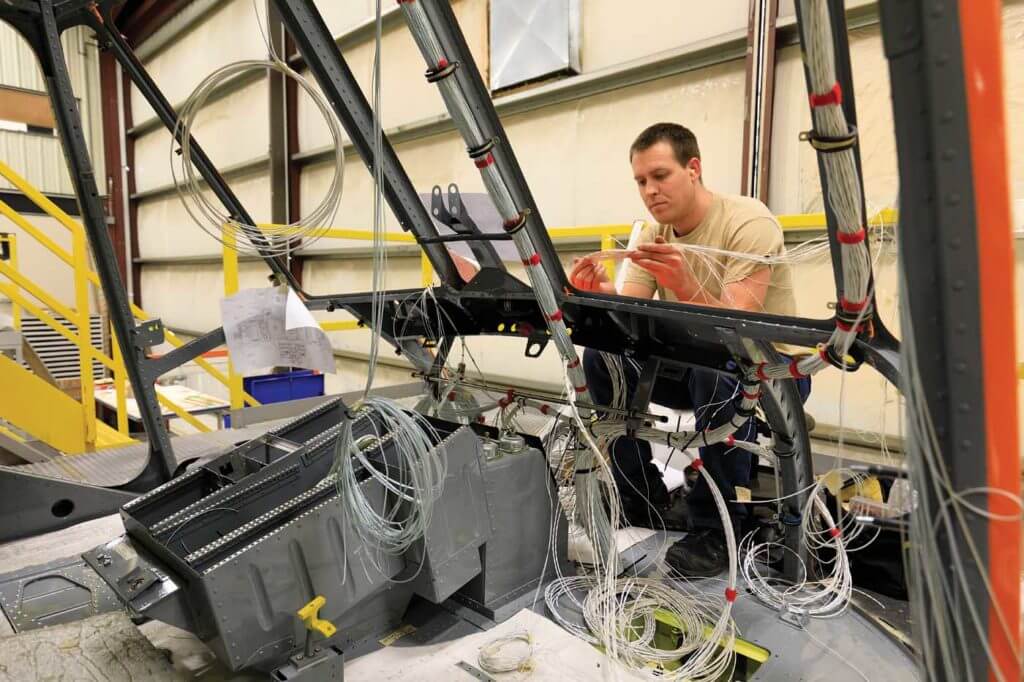

The company’s engineers quickly worked to develop new repairs that would allow parts previously determined to be unsalvageable to return to service.

“It’s been a challenge, but the guys have embraced it and enjoyed it,” said Kevin Haataja, component repair and overhaul manager. “The manuals were difficult to follow — a total 180 from what you’ve learned with the Sikorsky product — so we’ve had to really gather the data and use our engineering to figure things out.”

With the realization that there was going to be continued support for the type, operators who had previously been looking to sell the aircraft began putting them back into service.

“It’s a really wide footprint for such a small community, but we’ve done our best to support each and every one of them,” said Saxbury.

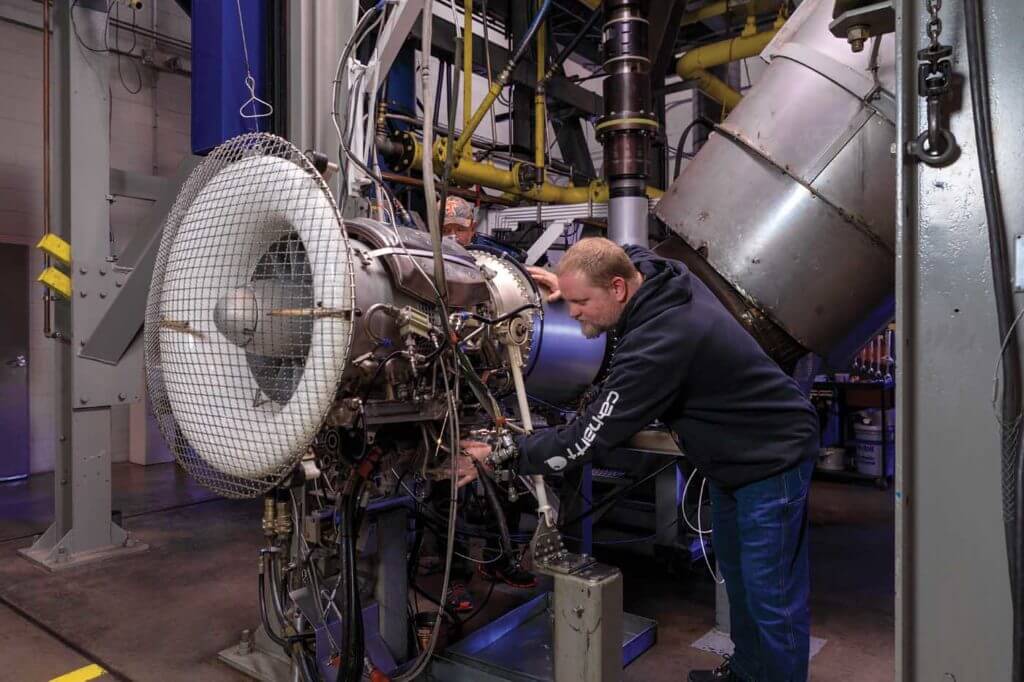

Similarly, Erickson has been working hard to develop new repairs and support capabilities for operators of the 4,800-shaft-horsepower JFTD12 engine (which powers the S-64), having bought the type certificate for it from Pratt & Whitney in 2013.

“We’ve started exploring doing rotating parts, discs, so we’re starting that machining process,” said Haataja. “It’s nice to be in control of your own destiny and we have enough rotational inventory for now. As years go by, we’ll need to keep expanding that.”

During the bankruptcy process, the MRO unit faced a considerable challenge to maintain its relationships with vendors within a very different paradigm — facing new pricing, new terms, and new lead times for parts.

“It really is a testament to the entire team,” said Saxbury. “It was a challenge for the MRO as well as the sales team to maintain relationships and to make sure we were meeting our commitments with our customers — because obviously, we were looking past when you emerge from the bankruptcy, those relationships are imperative to you to continue to grow and have success.”

Despite these challenges, the MRO unit grew its revenue by 15 percent, and is anticipating 30 to 40 percent growth in 2019.

Thanks to this success, the overall company managed to not only sustain its business, but grow during the bankruptcy process.

“We didn’t lose any customers, and the fact that we were able to continue growing the business through that is a testimony to the strength and value proposition of the platform, as well as the strength of the team,” said Kitani. “We have been working hard to maintain a good rapport with our key partners and vendors. It’s been improving every week and month since I’ve been here — but we still have a lot of work to do.”

Looking ahead, Erickson has been busy building its leadership team under Kitani, with several key appointments in the last few months. With the right people in the right positions, and a line drawn under the previous era, Kitani is clear that the future is bright for one of the helicopter industry’s most iconic names.

“This is about leadership and having the right culture, values and vision,” said Kitani. “I’m excited by this team that is now largely in place. There are so many great people at Erickson, and I think with their capabilities, anything is possible.”

Just saw Bubba two days ago up close and personal in Batesville, Arkansas while they stopped for fuel. Last time I was that close to a Flying Crane was in Vietnam in 1967-68. Such a beautiful piece of work. Actually this is the only helicopter with wheels that I like.

A old Huey B model guy!

George Cathey

116th Assault Helicopter Company

Cu Chi, Republic of South Vietnam